how much does the uk raise in taxes

In 202122 the value of HMRC tax receipts for the United Kingdom amounted to approximately 71822 billion British pounds. That would be an extra 91000 in tax revenue per person.

The Top Rate Of Income Tax British Politics And Policy At Lse

According to the 20182019 Government Expenditure and Revenue in Scotland GERS report tax revenue in north of the border amounted to.

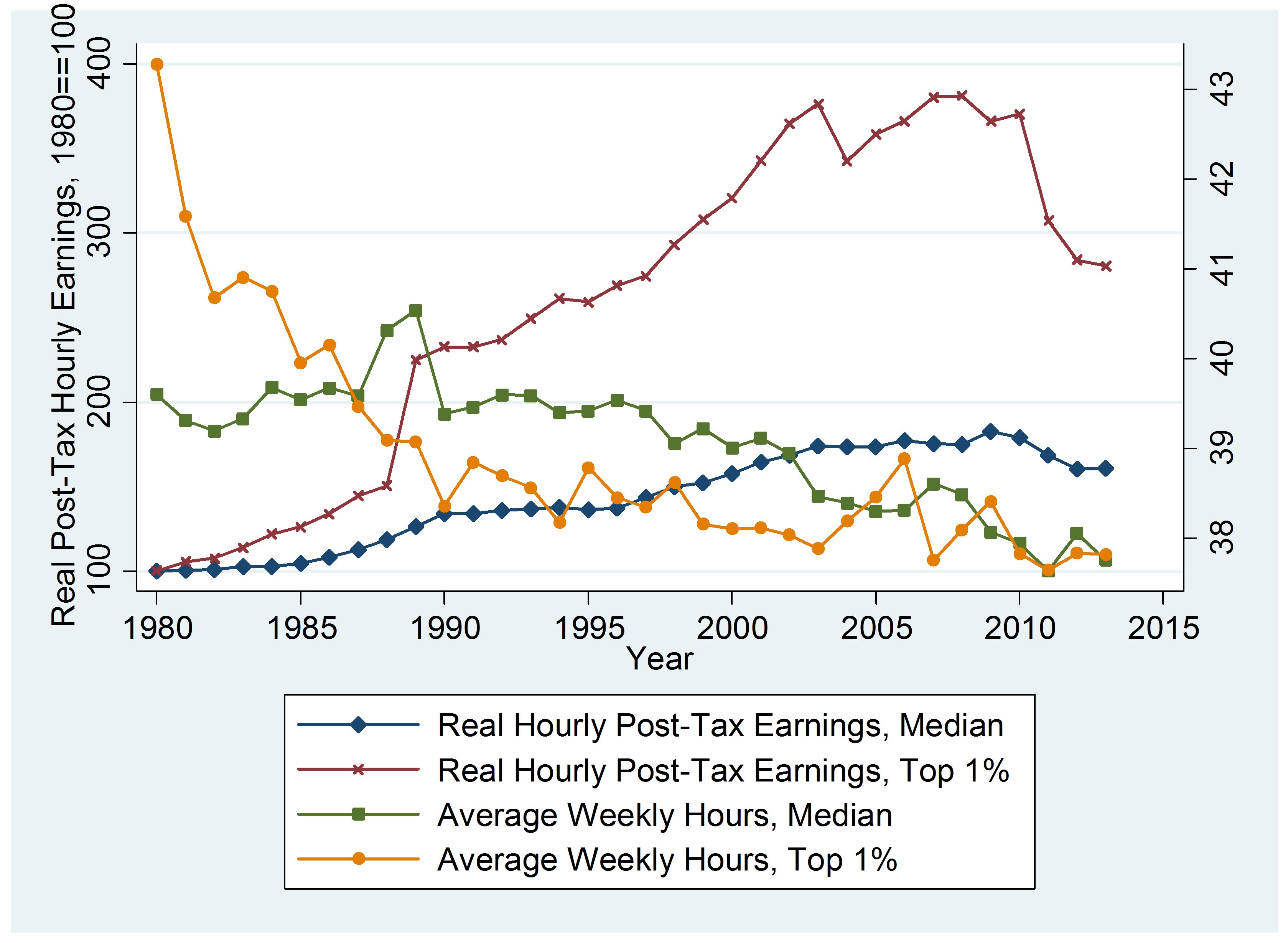

. The average rate for the higher earner would increase from 51 to 67 if the UK imported the Belgian tax system. However inequality in the UK has increased since 1980. This would require those receiving more than 100000 from all forms of remuneration to pay at least a 35 per cent tax rate on their income plus gains.

Total tax receipts in 201718 are forecast to be 690 billion. This represented a net. For comparison that sum would be worth 245billion today based on historic inflation.

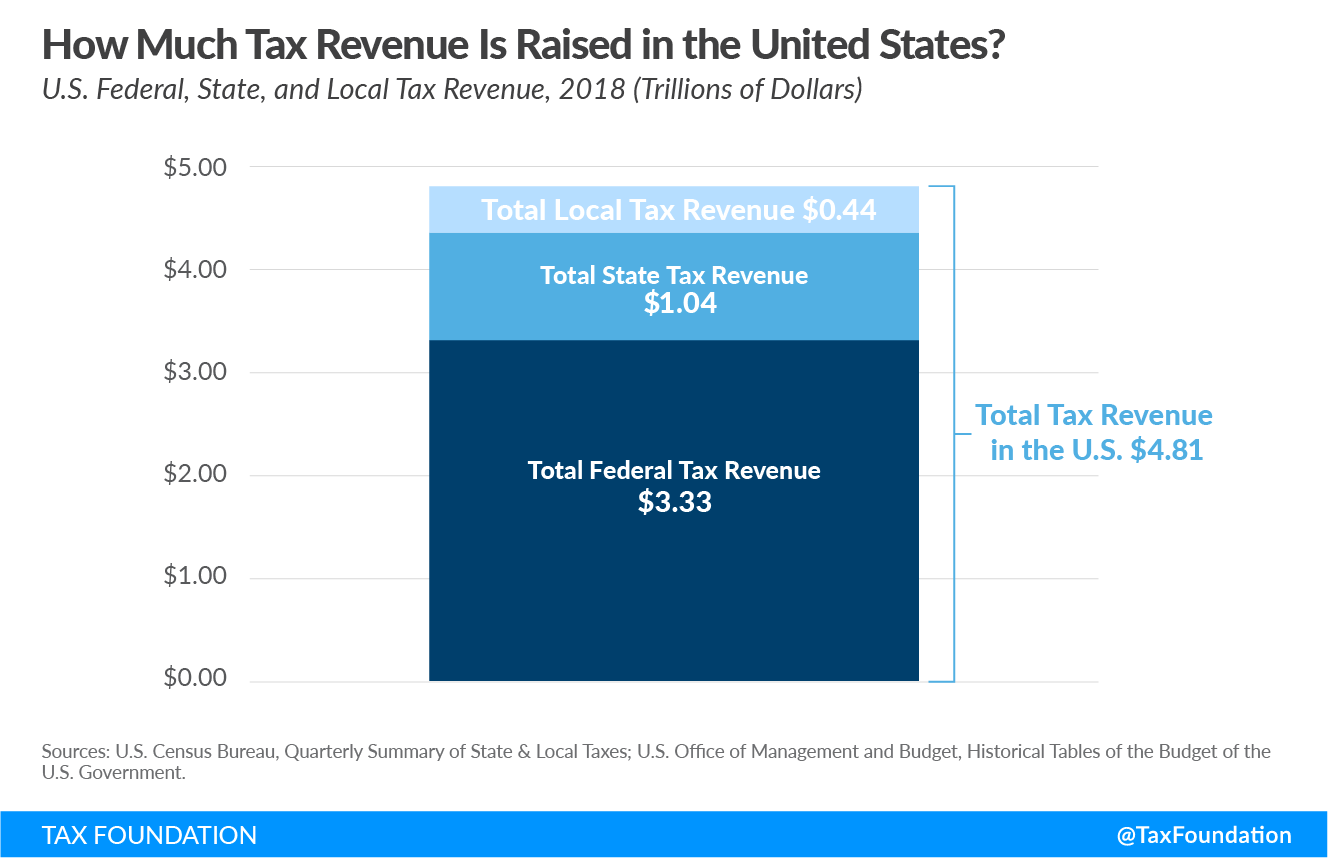

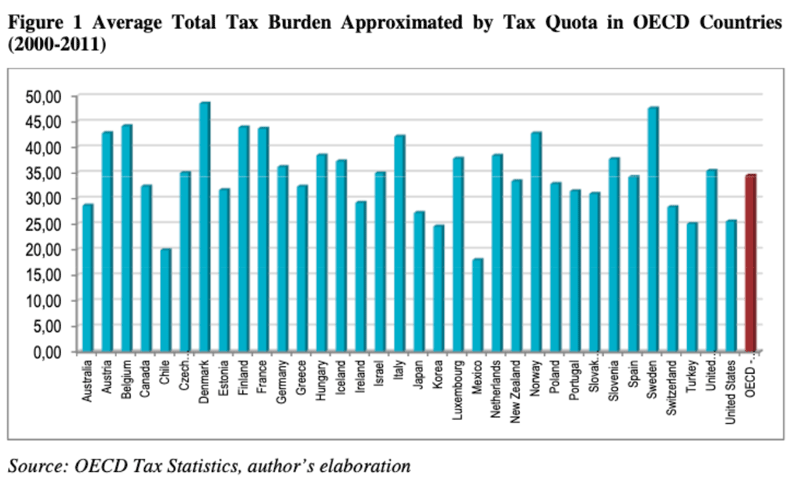

This is more than the UK. How much money does Scotland contribute to the UK in taxes. UK tax revenues were equivalent to 33 of GDP in 2019.

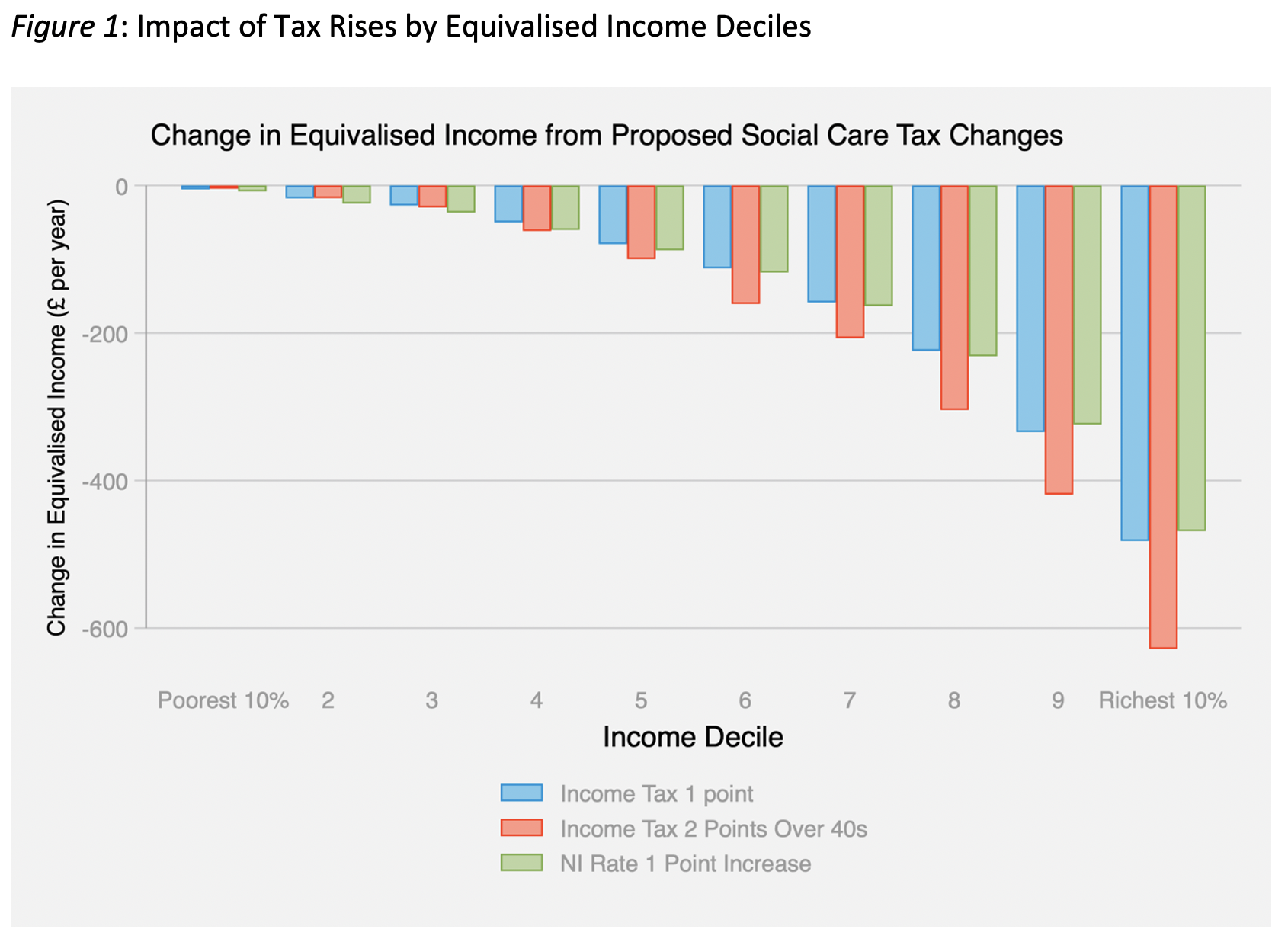

Has at pretty much any point in time. The original 125 percentage point increase in NI was supposed to raise 12bn a year. This is slightly below the average for both the OECD 34 and G7 36 and considerably lower than many other European countries average tax revenue among the EU14 was 39 of GDP in 2019.

The earliest records held at the Institute of Fiscal Studies are for the tax year 197879 when the UK Government raised 49billion in VAT. In our latest forecast we expect landfill tax to raise 08 billion in 2019-20. In 2019-20 VAT raised 134 billion this measure of VAT excludes refunds of VAT made to certain public sector organisations.

8 hours agoUnder the SEIS today for instance a company can raise as much as 150000 pounds 188000 from individual investors who would then be able to receive a reduction on their income tax liability. Has always averaged around 35-38 GDP tax take. The richest 10 pay over 30000 in tax mostly direct income tax.

But receive over 5000 in tax credits and benefits. Government revenue comes from taxes. Labour has proposed a 10 percentage point increase on corporation tax for oil and gas companies.

Tax on share dividends will also be increased by 125 percentage points in a move expected to raise 600m. Receipts have recovered their pre-recession share of national income and on current policy are set to rise slightly as a share of national income between now and 201920 and then remain relatively flat until the end of the forecast horizon Figure 1. 16 hours agoThe energy giant reported an underlying profit of 62bn 49bn compared to 26bn in the same period last year - ahead of expectations.

Currently taxes around 38 of GDP. Taxes as defined in the National Accounts are forecast to raise 6229 billion equivalent to roughly 11800 for every adult in the UK or 9600 per person. The government says the changes are expected to raise 12bn a year.

In 2022-23 we expect fuel duties to raise 262 billion. No matter the income tax rate 20 or 90 the UK. Increasing the point at which people start paying it will cost more than half.

In line with inflation there will be an increase in allowances and the basic rate limit. Companies with profits between 50000 and 250000 will pay tax at the main rate reduced by a marginal relief providing a gradual increase in the effective Corporation Tax rate. How much does the UK raise in tax compared to other countries.

That would represent 27 per cent of all receipts and is equivalent to around 930 per household and 10 per cent of national income. You do not get a. Overall the average household pays 12000 in tax and receives 5000 in benefits.

Currently spends around 42 GDP so we run a deficit since w. The increase in corporation tax from 19 to 25 in 2023 would mark the first attack on company profits since the Labour chancellor Denis Healey raised corporation tax in 1974 in the wake of the. The main rate of corporation tax will increase from 19 to 25 as of April 2023 and companies that earn less than GBP 50000 per year will see their small profits rate increase from 19 to 19.

From 168 billion in 202122 to 6 billion in 202223. The poorest 10 pay 4000 in tax mostly indirect VAT excise duty. What is the tax increase for.

From 229 in total income taxes it is anticipated that receipts will increase. Answer 1 of 10. You can also see the rates and bands without the Personal Allowance.

They receive around 2000 in benefits. Fuel duty is levied per unit of fuel purchased and is included in the price paid for petrol diesel and other fuels used in vehicles or for heating. Much of the revenue initially.

This represented 7 of the governments total revenue in that year. By 2025 26 billion people will have access to. How much money does Scotland contribute to the UK in taxes.

It estimates that a year-long rise in the tax bills of energy giants would raise 12bn for the.

Tax On Test Do Britons Pay More Than Most Tax The Guardian

Types Of Tax In Uk Economics Help

How Do Taxes Affect Income Inequality Tax Policy Center

Government Revenue Taxes Are The Price We Pay For Government

Uk Spring Statement Updates From March 23 Sunak Cuts Fuel Duty And Promises Lower Income Tax Financial Times

Government Revenue Taxes Are The Price We Pay For Government

Boris Johnson And Rishi Sunak Have Announced Tax Rises Worth 2 Of Gdp In Just Two Years The Same As Tony Blair And Gordon Brown Did In Ten Institute For

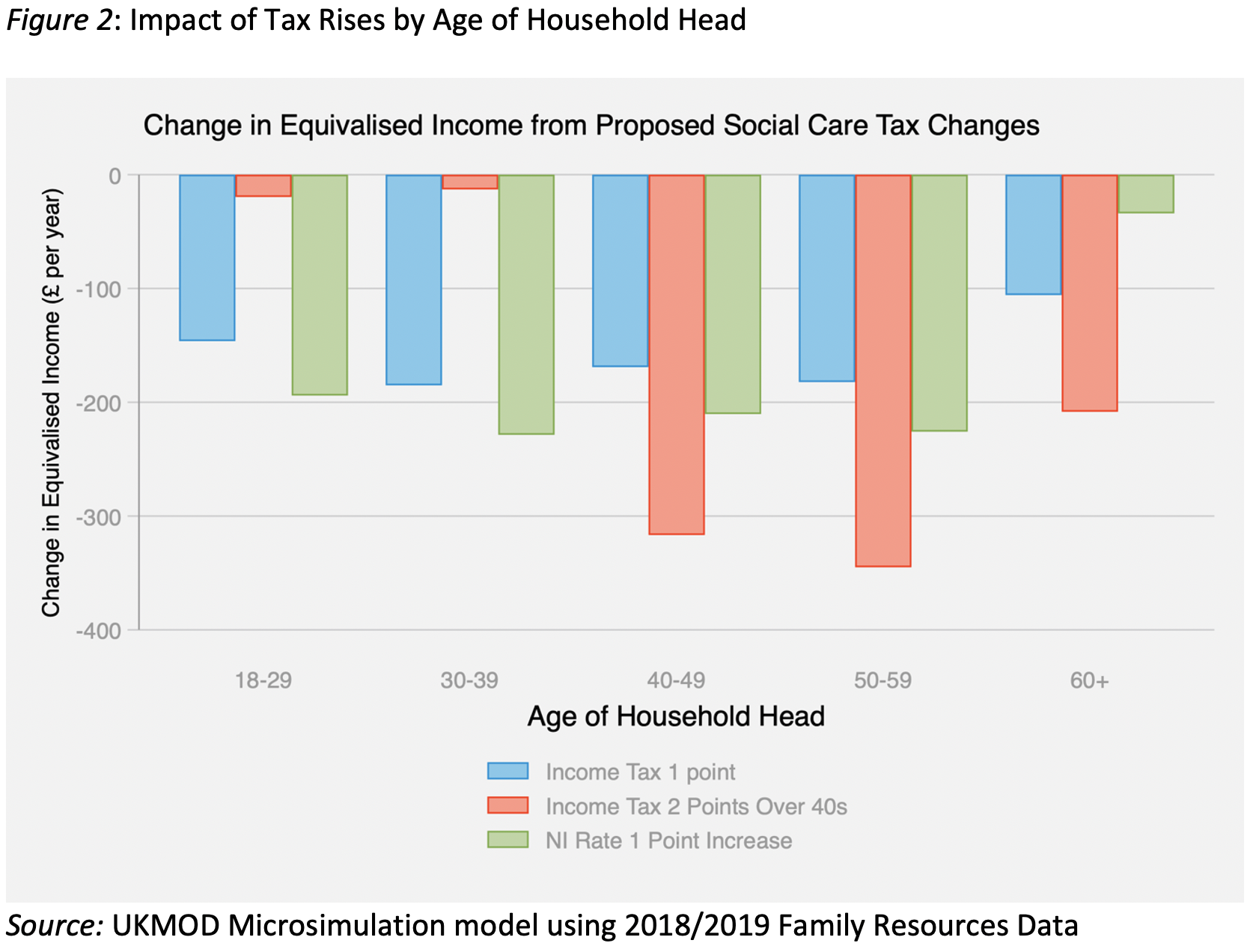

Young People Without Rich Parents Will End Up Paying For A Rise In National Insurance To Fund Social Care British Politics And Policy At Lse

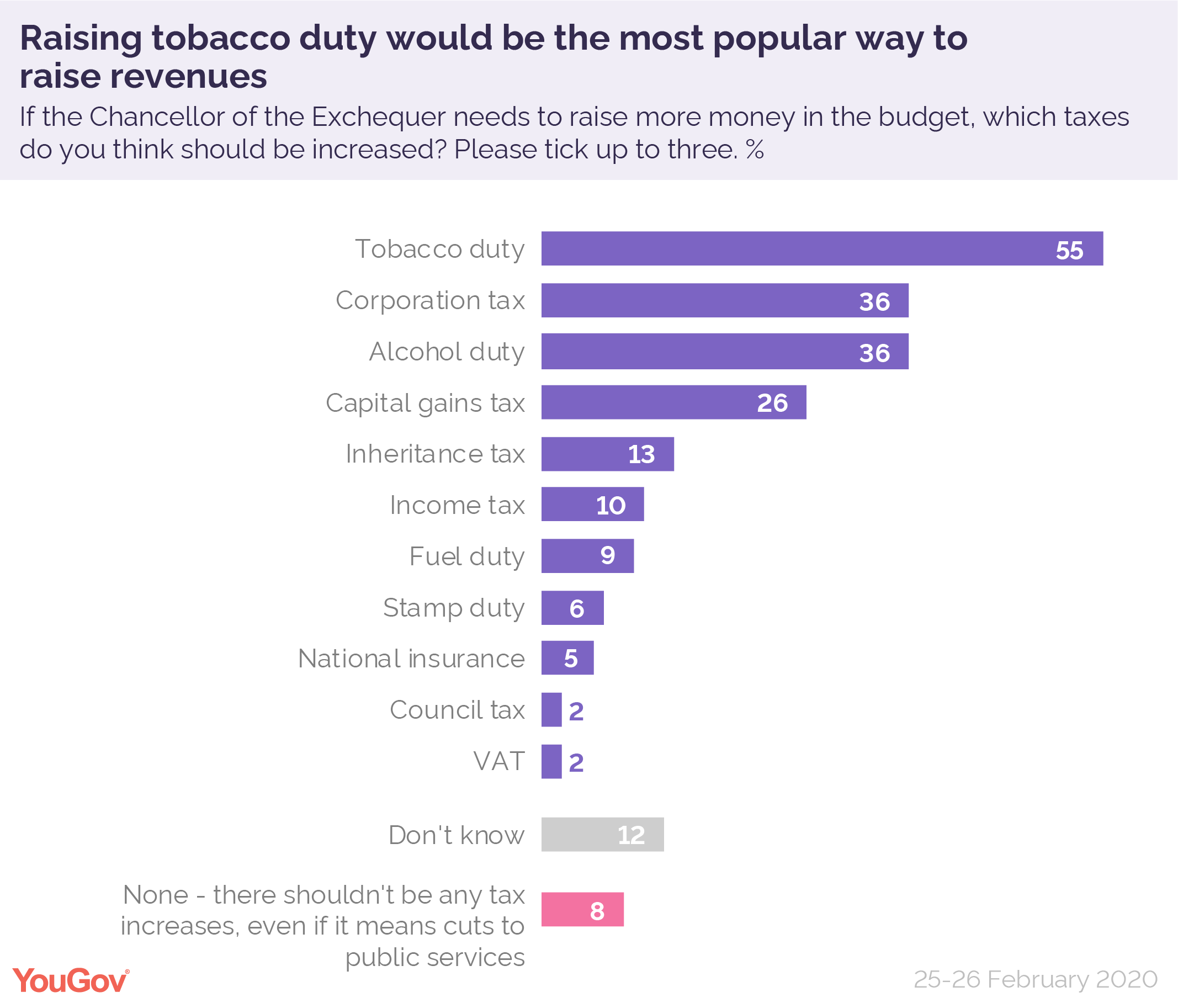

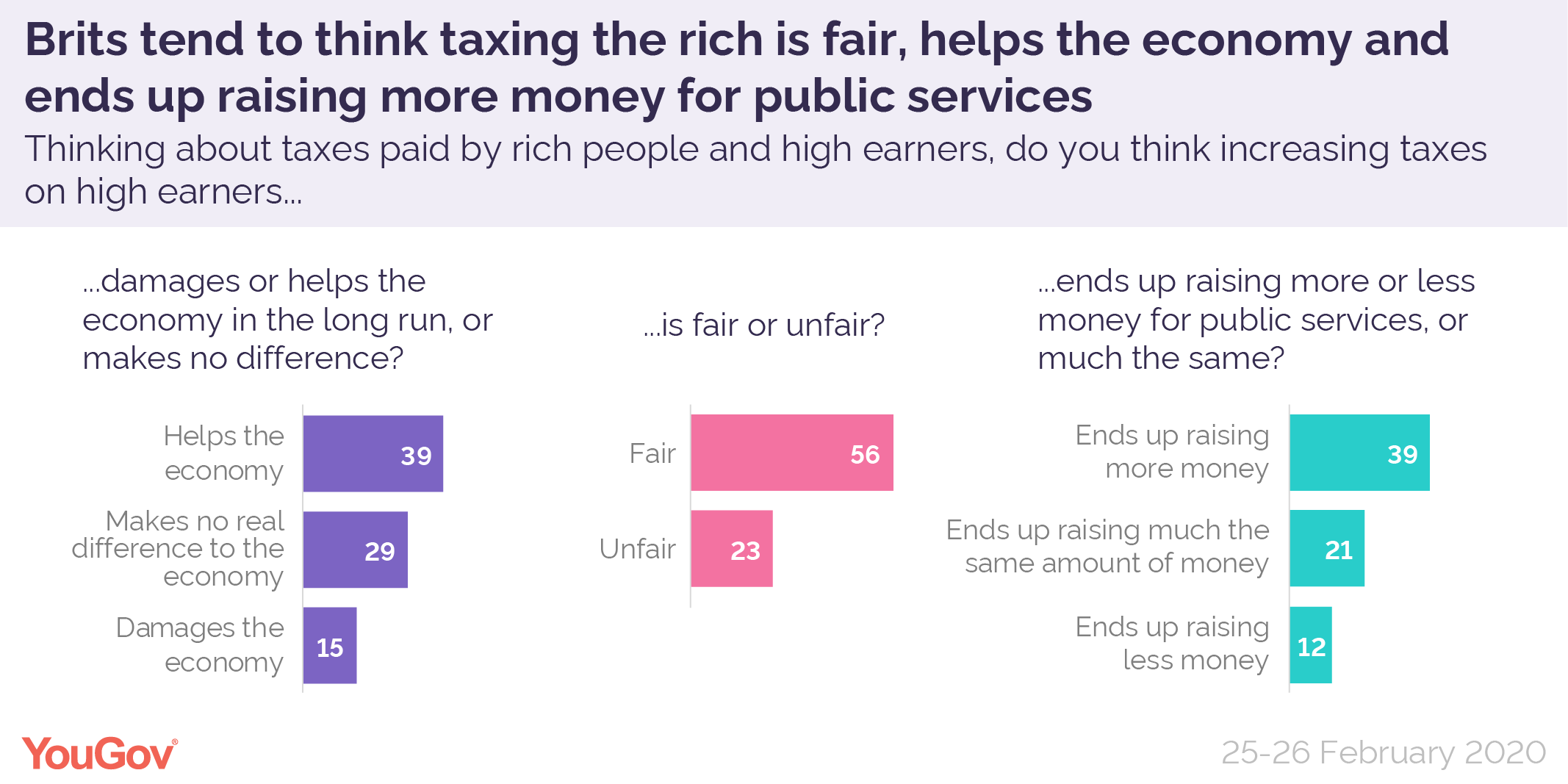

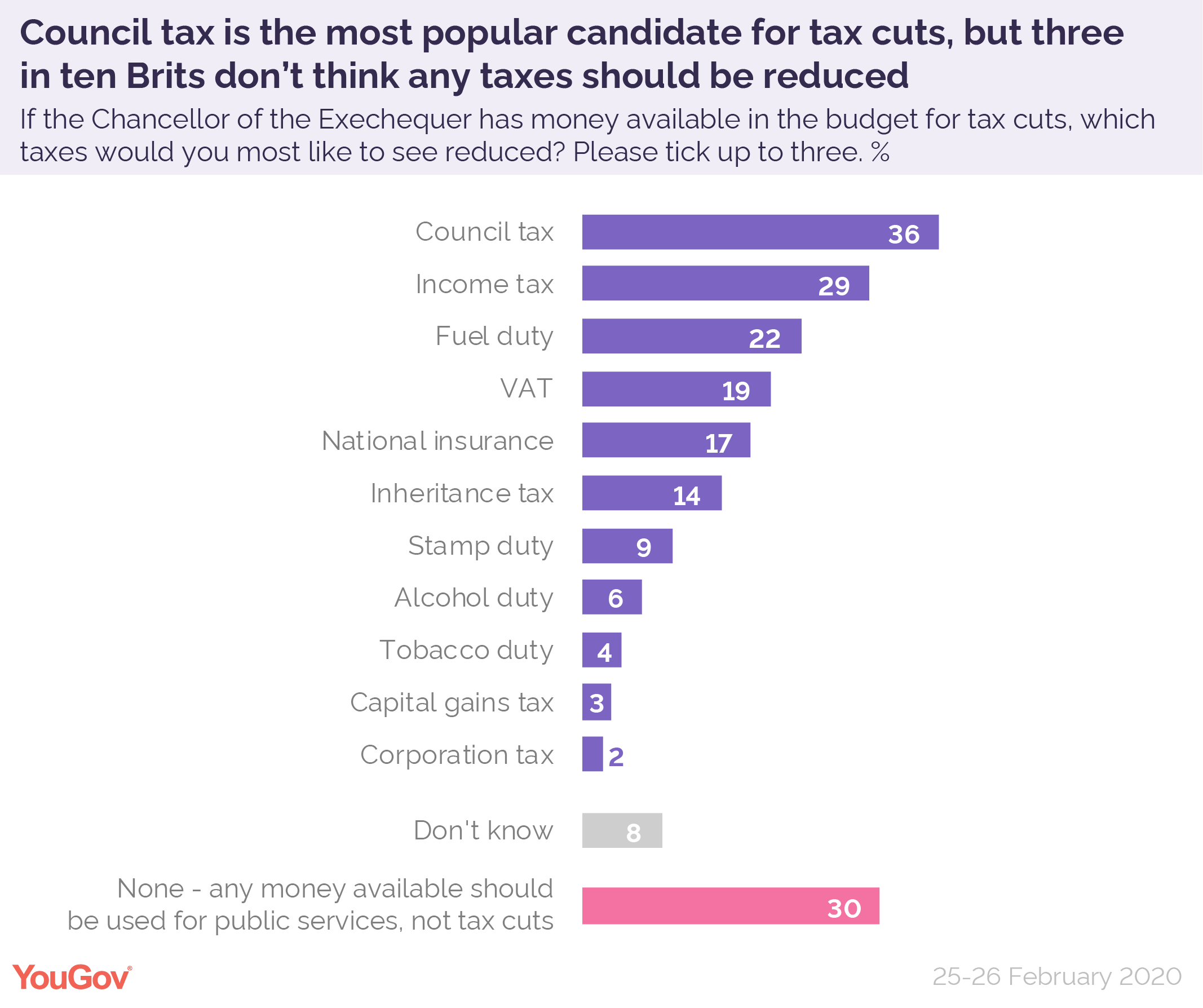

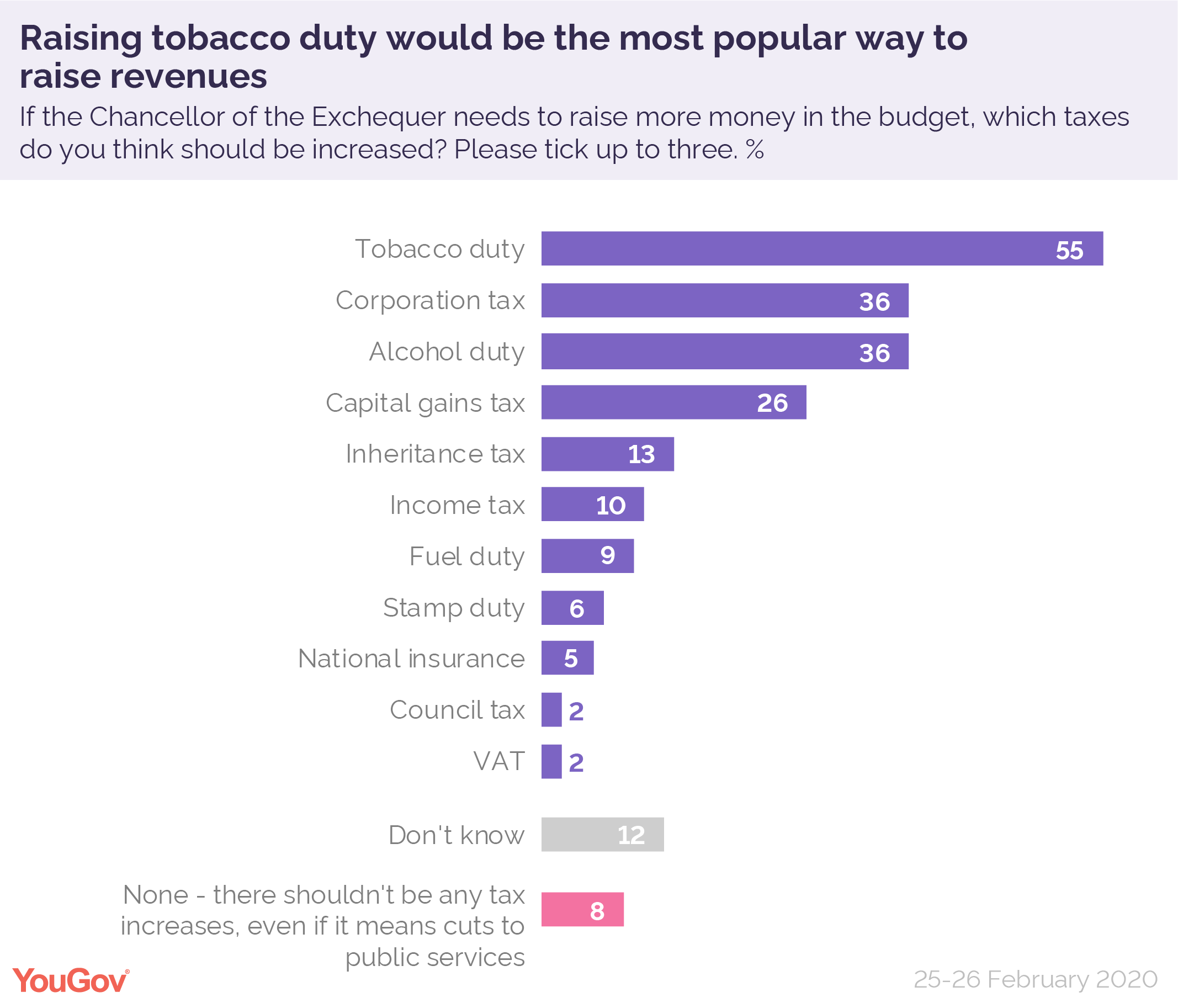

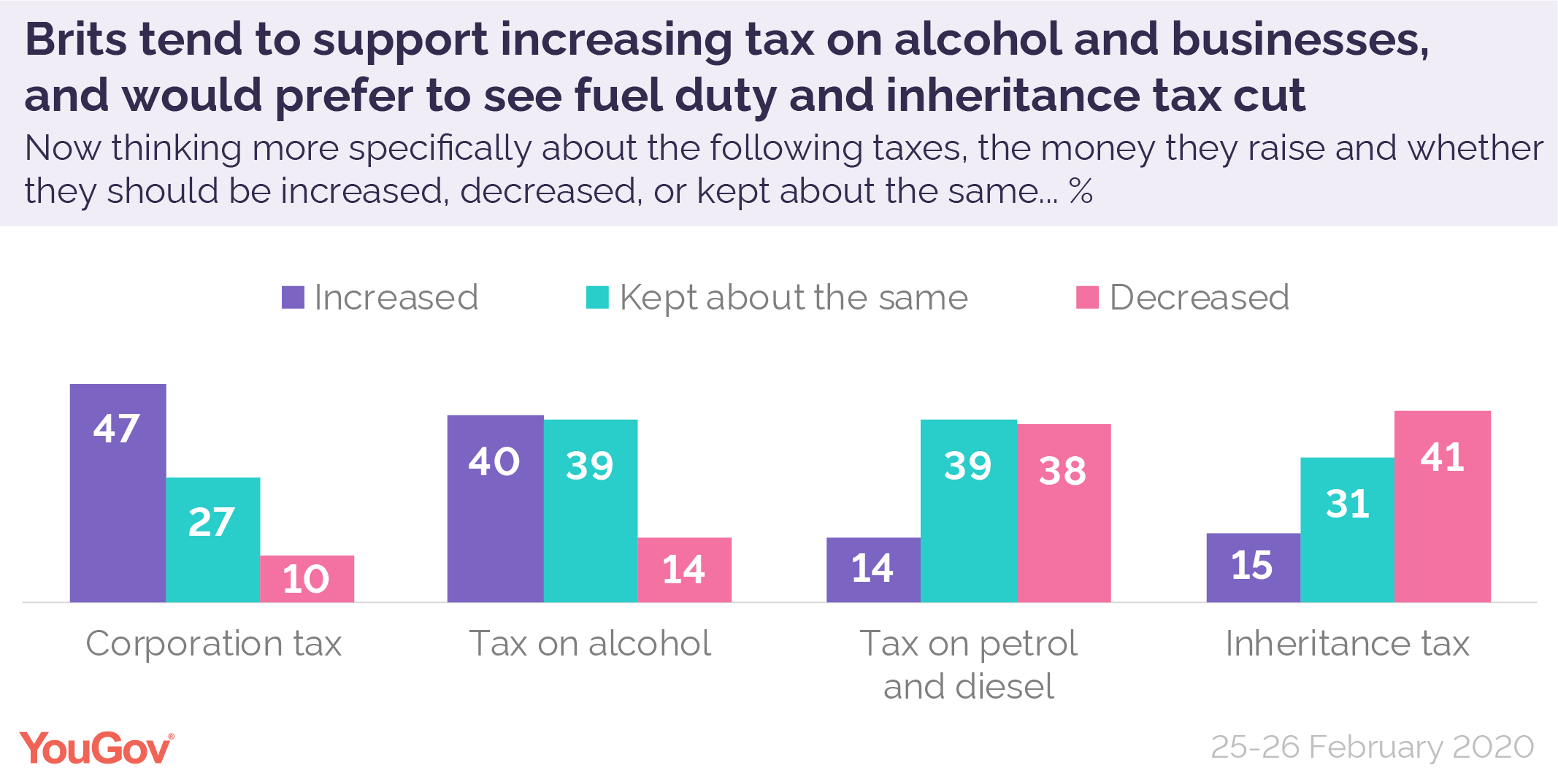

Budget 2020 What Tax Changes Would Be Popular Yougov

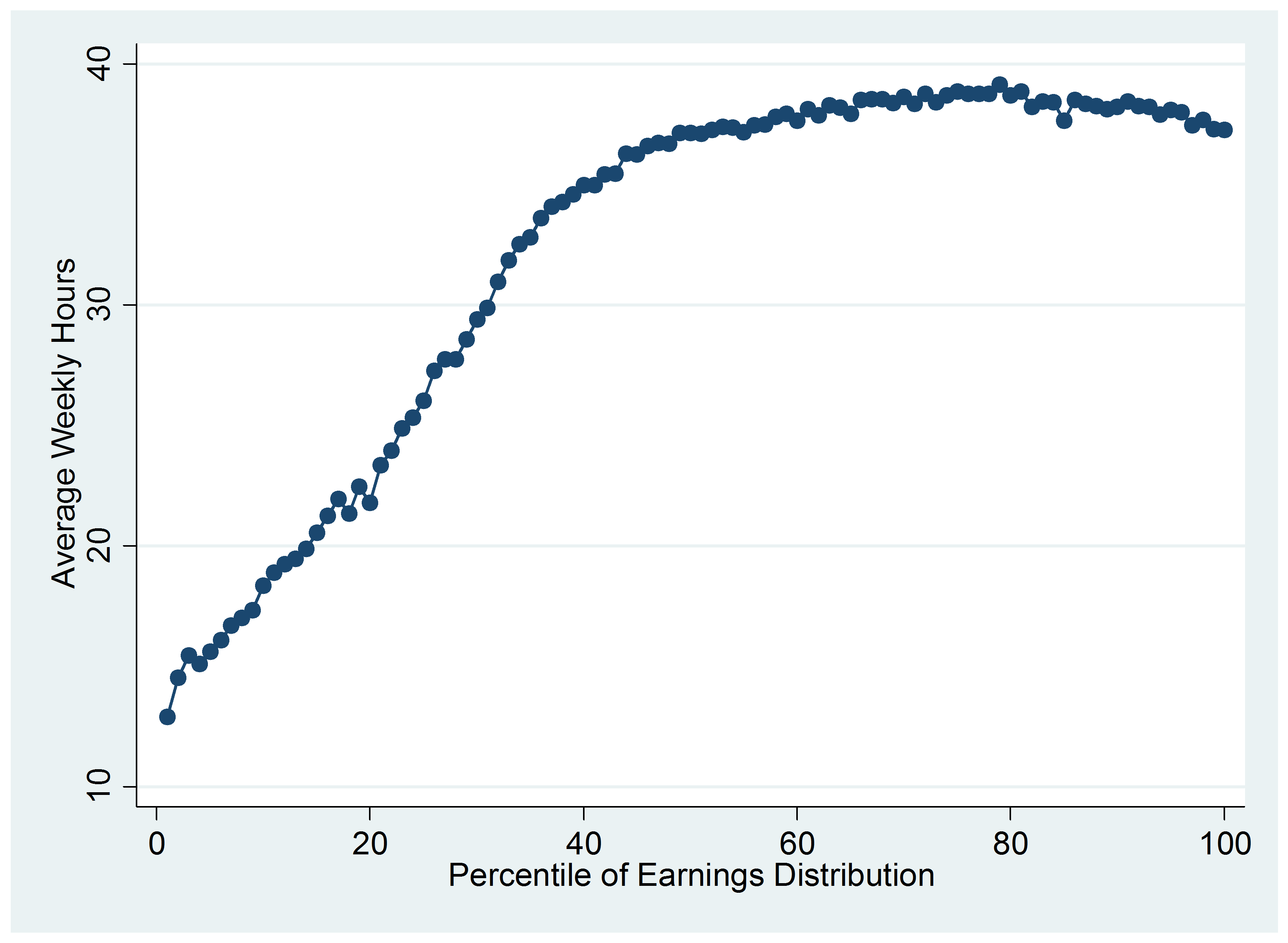

The Top Rate Of Income Tax British Politics And Policy At Lse

Budget 2020 What Tax Changes Would Be Popular Yougov

Young People Without Rich Parents Will End Up Paying For A Rise In National Insurance To Fund Social Care British Politics And Policy At Lse

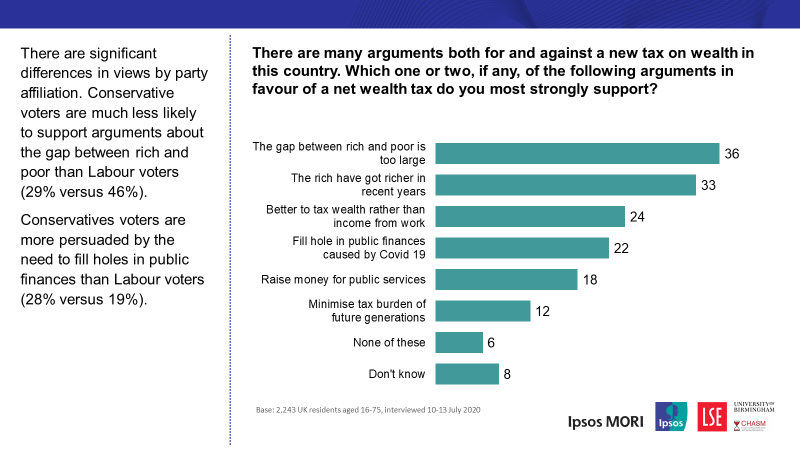

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos

Budget 2020 What Tax Changes Would Be Popular Yougov

The Impact Of Taxation Economics Help

Are Britain S High Earners Taxed Too Much Or Too Little Tax The Guardian

Budget 2020 What Tax Changes Would Be Popular Yougov

The Top Rate Of Income Tax British Politics And Policy At Lse